"there are so many ways to make money"

the mindset shift that turns one income into many

“Wow, there are so many ways to make money.”

My friend said these words to me while we were having dinner a few days ago. We were discussing her business. Then my businesses. Passive income streams. Trades. Investments.

There was an energy to the conversation. Each idea sparked another, then another, then another, until the room was blazing with possibility.

Money was no longer a single path.

We had created a beautiful web of opportunity between us.

Where each path opens three more doors. Then five. Then more.

Most people don’t realize money works like this.

We’re taught to see it as one path. One paycheck. One investment account (maybe). Until retirement.

Boring. I want to show you how money multiplies.

But first, we have to talk about the trap of the single paycheck.

The Single Paycheck Trap

By the age of 5, we’re trained into the system.

Go to school.

Learn stuff to get a job.

Get a job and earn a paycheck.

Earn a paycheck to “make a living”

It’s a survival script. Linear. Predictable.

Marketed as “safe”.

One paycheck is anything but safe.

When all of your income flows through a single employer, you’re at the mercy of decisions you don’t have any control over. Tomorrow you could wake up to news of a reorg. A funding pullback. Some new technology that makes your role redundant.

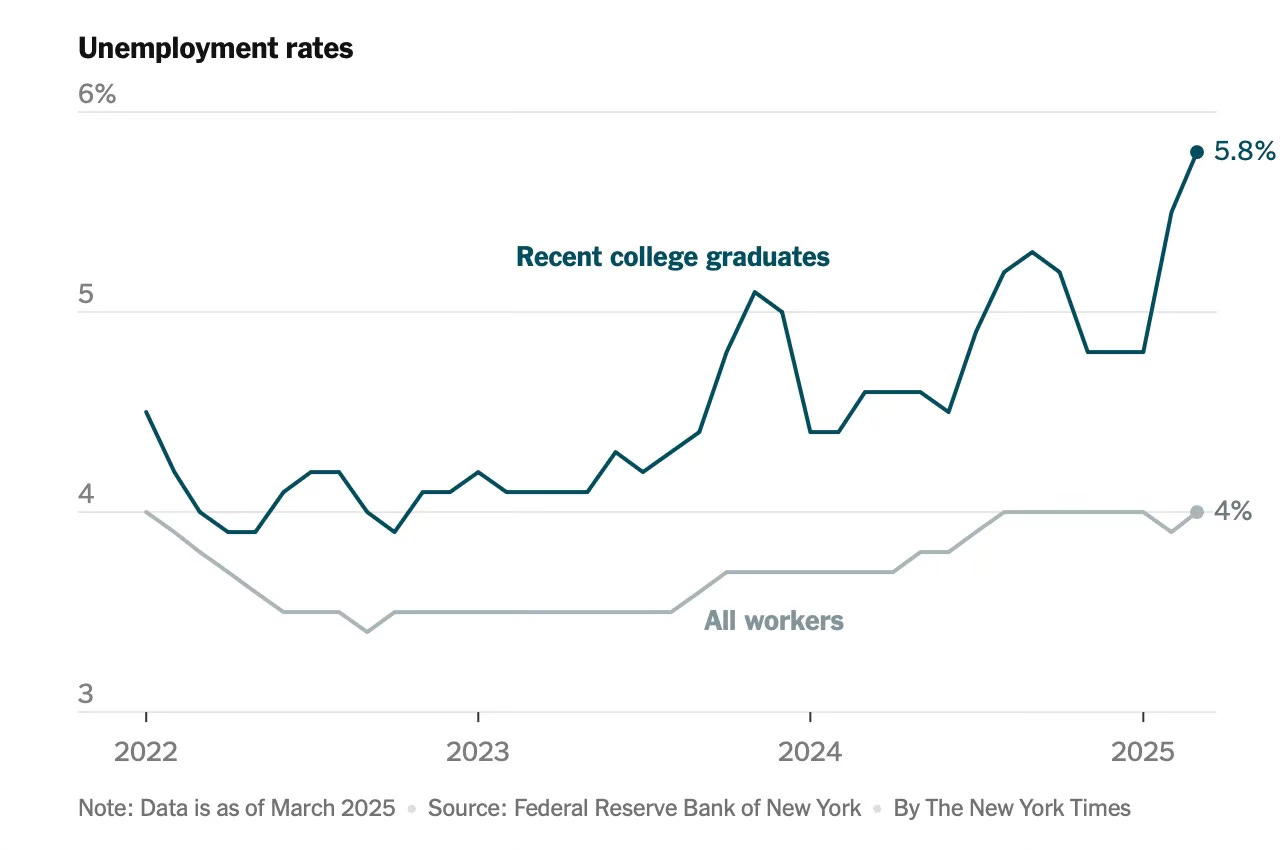

We wake up to daily news of another round of layoffs. Many of these being the “safe” jobs your parents, teachers, and society told you to aim for. Coupled with these layoffs, is the stark reality that college grads are facing the highest unemployment rates since 2013.

It can feel easy to blame AI for this but from the conversations I’m having with recruiter friends, this is stemming from broader economic uncertainty above everything else.

The future of work is changing. And this is where the danger of dependence comes in.

If you’re dependent on one paycheck to provide for your livelihood, you are a guest in someone else’s home.

In this case, you’re a guest in your employer’s home. And maybe you don’t like the food they serve. Or how they treat their pets. Or the way conflict gets handled under their roof. But as long as you depend on them, you keep your mouth shut.

You trade your freedom for access. Your voice for a place at the table. Your fulfillment for a paycheck that might not even keep pace with rent. You might do everything “right” while staying as a guest in your employer’s home. And still one day.. they might decide to kick you out.

The same can be said for a business owner with one client or one product. Whether you're self-employed or not, the trap of a single income remains the same.

Linear. Predictable. Marketed as “safe.”

One paycheck is anything but safe.

Multi-Income Mindset

The alternative here is what I call the multi-income mindset.

To start seeing money the way investors see assets.

Money as a portfolio of income where one stream pays for your housing, another for health and travel, another for investments, with several more compounding quietly in the background.

Despite all the doomsday news about layoffs and hiring freezes, it’s never been easier than it is today in 2025 to build your own multi-income portfolio. AI lowers the cost of both education and creation. The creator economy rewards individuality and distribution. Remote work dissolves borders. Digital platforms let you monetize in hours what once took months.

When you’re still thinking in terms of a salary and retirement accounts, or even running a business with one revenue stream… your security is anchored to a single point of failure. That’s why headlines about rising unemployment or AI replacing jobs feel terrifying.

But with a multi-income mindset, those same headlines read much differently.

They’re signals. Motivation. Reminders… that security doesn’t come from loyalty to one employer or one product.

Real security is about giving yourself options.

Options to pivot careers and take a sabbatical without stress. Optionality to live in New York in the summer and Scottsdale in the winter. The freedom to say no to work that drains you. The choice to design work around your life and wake up daily on your terms.

That’s the mindset.

But a mindset only matters if you turn into practice.